Which of the Following Are Ways to Amortize a Loan

A loan amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the. Textbook Solutions Expert Tutors Earn.

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster

Total interest amount 7539758.

. Find a simple mortgage calculator online visit the URL to a under Resources. Amortization Cost of Asset Number of years of the economic life of the asset. Pay only the interest every period and pay the principal off at maturity.

As we can see from the two scenarios the longer 30-year amortization results in a more affordable. Click on Print Preview to see. Which of the following are ways to amortize a loan.

However if you prefer to amortize a loan by hand you. There are two general definitions of amortization. Loan Payment Calculator With Amortization Schedule.

Principal Payment A principal payment is a payment toward the original amount of a loan that is owed. Your interest rate 6 is the annual rate on the loan. An amortizing loan is a type of loan that requires monthly payments with a portion of the payments each going towards the principal.

The two are explained in more detail in the sections below. Ascertain the 3 pieces of advice you need in order to compute the amortized payment of a loan. The second is used in the context of business accounting and is the act of spreading the cost of an expensive and long-lived item over many periods.

Amortized Loan Formula Borrowed Amount i 1i n 1i n 1 Here The rate of interest is represented as i. The loan term the rate of interest and the amount charged. View WHICH OF THE FOLLOWING ARE WAYS TO AMORTIZE A LOANpng from ACCT MISC at American Public University.

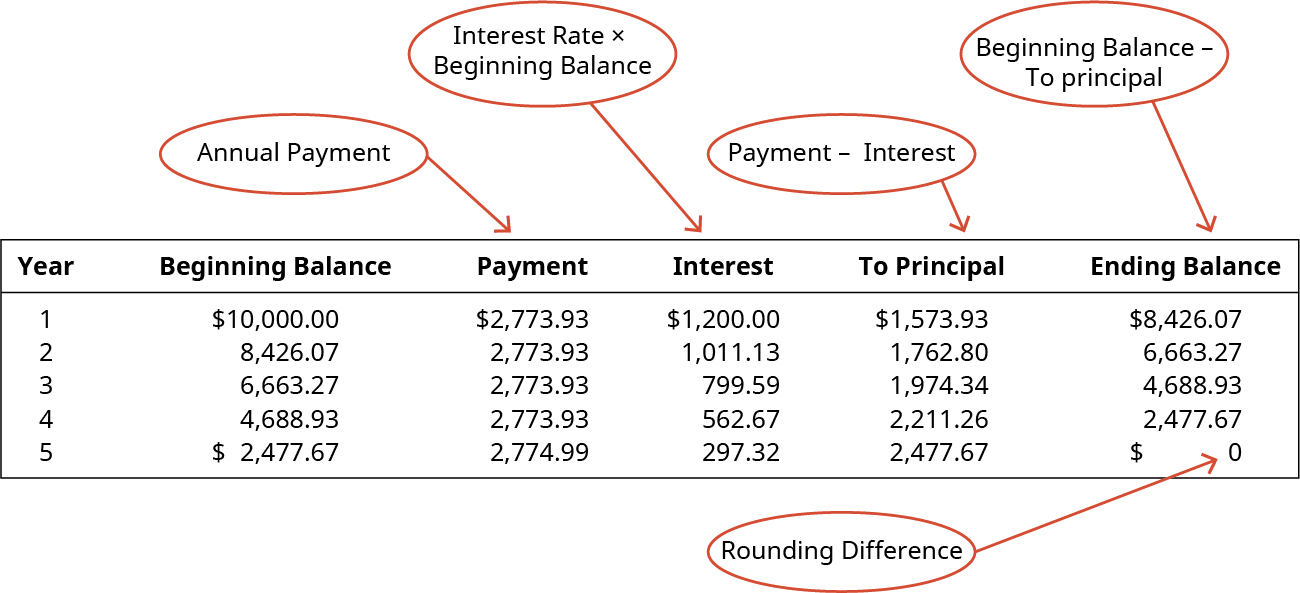

To calculate amortization you will convert the annual interest rate into a monthly rate. The tenure of the loan is represented as n. The easiest way to amortize a loan is to use an online loan calculator or template spreadsheet like those available through Microsoft Excel.

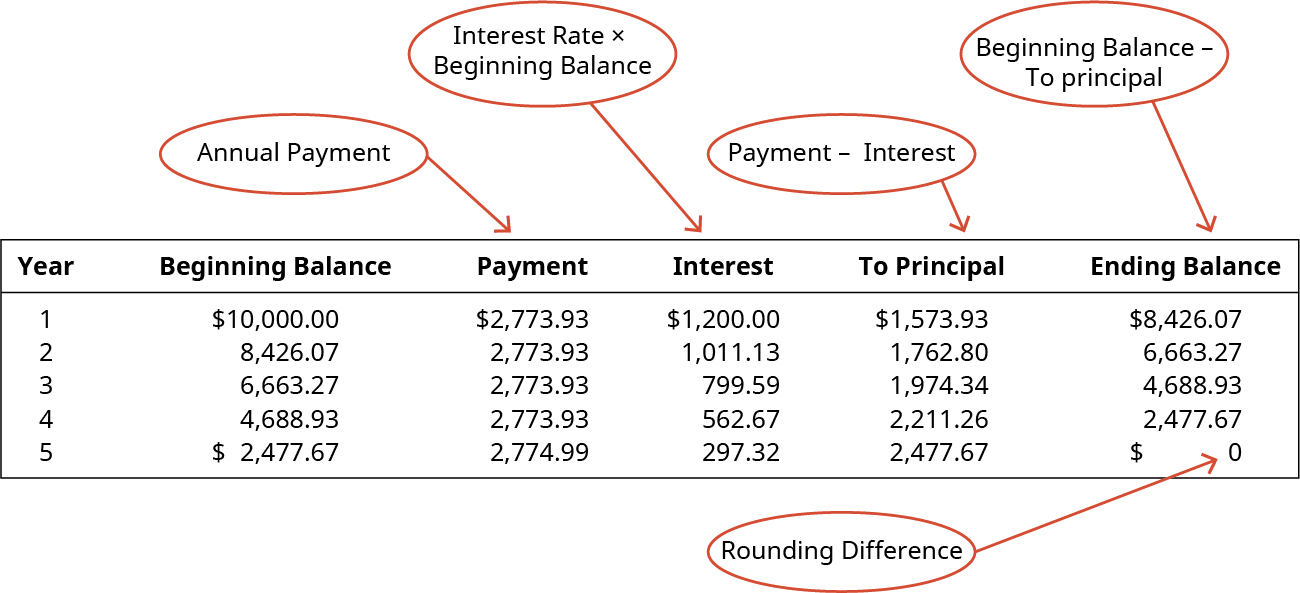

The loan amount interest rate term to maturity payment periods and amortization method determine what an amortization schedule looks like. N total number of payments. The original amount of a loan is termed the loan ____.

R interest rate monthly annually quarterly. A portion of each loan payment will go towards the principal of the loan and the remainder will go towards interest charges Interest Expense Interest expense arises out of a company that finances through debt. You are free to use this image on your website templates etc Please provide us with an attribution link.

Amortization methods include the straight line declining balance annuity bullet balloon and negative amortization. Monthly payment 152999. Then once you have computed the payment click on the Create Amortization Schedule button to create a chart you.

Pay the principal and interest every period in a fixed payment. Your monthly payment is 59955. Pay principal and interest every period in a fixed payment.

Pay the interest each period plus some fixed amount of the principal. An amortized loan is one where the principal of the loan is paid down according to an amortization schedule typically through equal monthly installments. Pay both interest and principal in one lump sum at maturity.

A payment amount. The first is the systematic repayment of a loan over time. Total loan cost 27539820.

Mortgage loans are generally amortized over a five- 10- 15- 20- 25- or 30-year period. _ Road about this Your answer Is. Which of the following are ways to amortize a loan.

It can be converted n total number of payments in the total period of the loan. P initial loan amount or Principal. Pay the interest each period plus some fixed amount of the principal.

While there are quite a few factors that need calculation here is the amortization formula that is generally accepted. -pay principal and interest every period in a fixed payment -pay the interest each period plus some fixed amount of the principal. The term of the loan is 360 months 30 years.

Calculated by frequency of payments. In other words a principal payment is a payment made on a loan that reduces the remaining loan amount due rather than applying to. Which of the following are ways to amortize a loan.

This calculator will compute a loans payment amount at various payment intervals -- based on the principal amount borrowed the length of the loan and the annual interest rate. Since amortization is a monthly calculation in this example the term is stated in months not years. A total amount of loan.

A simple way to amortize a loan is to have the borrower pay the interest each period plus some fixed amount. This approach is common with _____-term business loan. R rate of interest.

Change the number of payments to the actual term of the loan - per this example thats 5 years or 60 payments. Enter 0 for the payment amount and click on Calc Result is the payment for a 30-year loan. Which of the following are ways to amortize a loan.

P a 1rn-1 r 1rn in this formula the annotations represent the following. An amortized loan is a type of loan that requires the borrower to make scheduled periodic payments that are applied to both the principal and.

Compute Amortization Of Long Term Liabilities Using The Effective Interest Method Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

No comments for "Which of the Following Are Ways to Amortize a Loan"

Post a Comment